Credit 101

Good day, When you do something day after day it becomes second nature. I do financing. I speak with major banks every day about the way they view an individual who has applied for a loan. There are many factors.

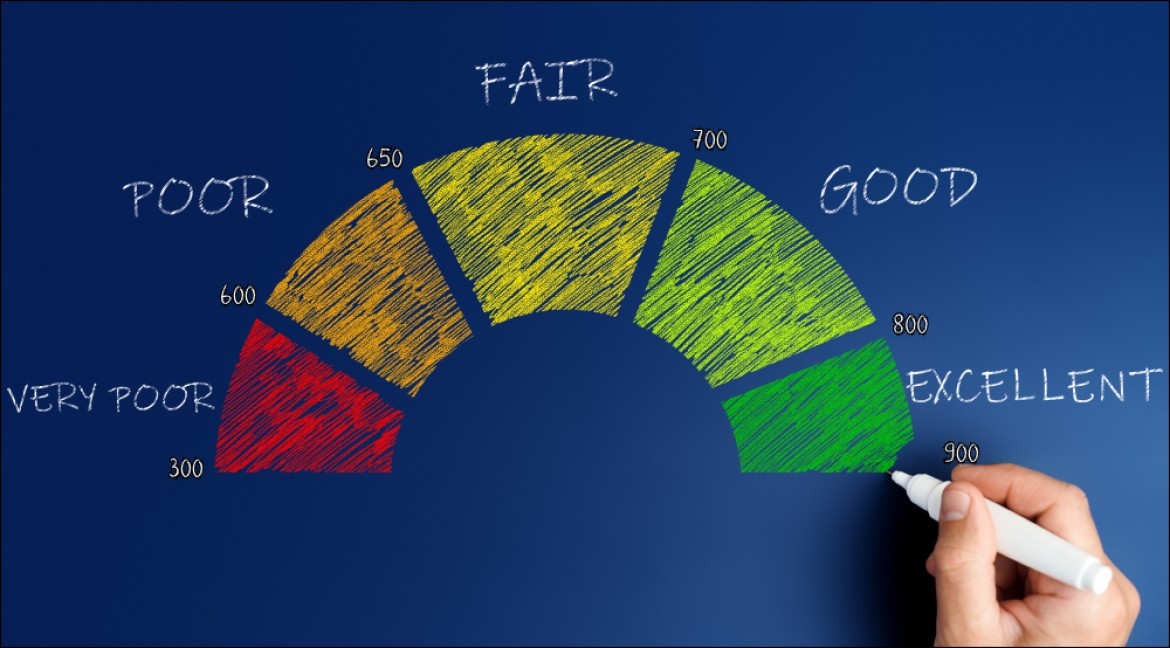

Today I will talk about one of the most important things, your credit score.

There are two credit reporting agencies in Canada: Equifax and Transunion. The names of the scores are Beacon and Fico score respectively. Each company scores and reports different. Most institutions pull credit information from Equifax.

The single most important thing to know is that missed or late payments will stay on your record for SEVEN years. These Derogatory remarks on the Credit Bureau or "Derogs" as they are known automatically stop you from being "Auto Approved". This means your application will only be adjudicated by a person. The banks computer has picked up the derog and spit your application into the NON Prime portal. Bank Credit personnel will decide your fate. People can be in a bad mood, hungry, tired etc or make mistakes. Beauty is in the eye of the beholder they say. Well, a computer score is predictable and workable a human score is subjective and restrictive.

A higher credit score will get you approved faster with less stipulations, best interest rate and terms for your new loan. This will give you flexibility in your vehicle selection and payment options. Your cost of borrowing will be less and your net worth will increase!

Thank you for taking the time to read this article. Stay tuned for more.

Comments